Microsoft's Chess Move: The Strategic Play in OpenAI

A Brilliant Masterstroke!

I was going through my feed a few days ago and noted Nate’s article with deep interest. Which, was basically about the “$100 billion profit threshold”, behind Microsoft’s investment in OpenAI.

The underlying story of that $100 billion profit threshold relates to the company's strategic investment and/or collaboration with OpenAI, particularly in the context of defining and achieving Artificial General Intelligence (AGI):

AGI Definition and $100 Billion Profit Threshold:

Microsoft and OpenAI have reportedly agreed that AGI would be considered achieved when there is sufficient evidence that the technology could generate $100 billion in total profits for investors, including Microsoft. This definition shifts the traditional understanding of AGI from being a cognitive milestone to a financial one. Oookay. Fine. Numbers work too.

Market Dominance vs. Human Flourishing:

Critics however argue that this financial benchmark for AGI reflects a focus on market dominance rather than the potential benefits of AGI for human advancement or ethical considerations (hard not to come to such a conclusion, really). This perspective suggests that the goal is more about commercial success than the broader implications of AGI for society. But who can blame them, right?

Implications of the Financial Definition:

This redefinition of AGI in terms of profit has raised concerns about setting a precedent where technological milestones are measured by commercial success rather than technological or ethical achievements. The approach could supposedly & potentially skew the development of AI towards profit-driven objectives rather than focusing on creating genuinely beneficial and safe AI systems. Again - should we even be mildly surprised? Microsoft is afterall a public company and answerable to shareholders for their very many value-creation undertakings.

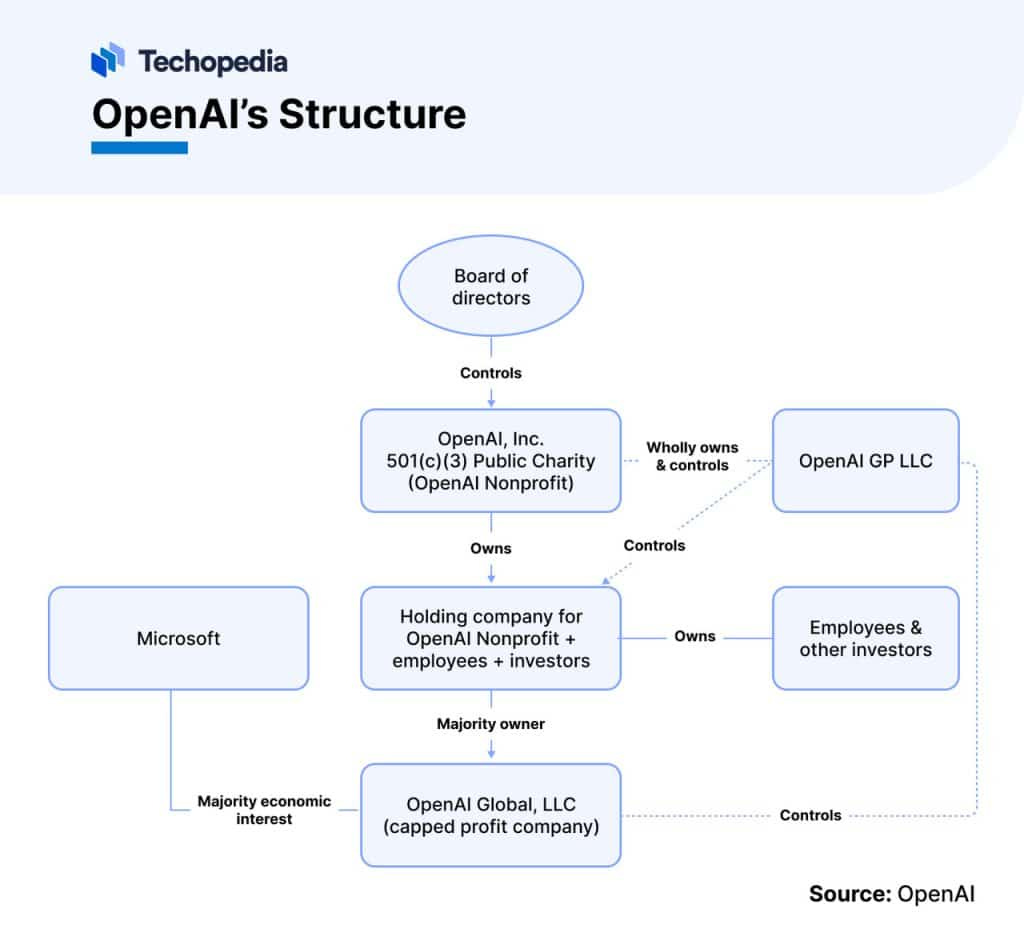

So far, to me at least, all this sounds fairly understandable. Reasonable, even. But how and where have these investments been directed? OpenAI’s corporate structure is not simple.

The Corporate Structure

Techopedia's Article is well worth a read for the ownership structure and relevant content (https://www.techopedia.com/who-owns-openai)

Based on the organizational structure provided and the information from various web results (publicly available), here's what I have been able to piece together:

(1) A breakdown of which OpenAI vehicle, specifically, each investment went through (esp Microsoft), and

(2) The general investment details of investment vehicles, companies, and/or nonprofits that took stakes in OpenAI

Note: This is an estimated high-level overview, and hence, will be subject to revisions or fine-tuning as further disclosures are made or shared. No recommendations tied to any form of investment should be implied by it, under any circumstance, or scenario.

Note: Any reference to equity means convertible preference shares (subject to relevant conversion ratios)

Notes:

The holding company serves as the vehicle for investments that involve a broader group including the nonprofit, employees, and various investors, ensuring alignment with OpenAI's mission while allowing for-profit participation.

OpenAI Global, LLC is the primary for-profit entity where strategic investments like Microsoft's and direct investments like NVIDIA's convertible debt are directed, providing a clear path for profit sharing and strategic technology integration.

The structure ensures that while profits are capped, the mission of benefiting humanity through AI remains central, influencing how investments are structured and managed across different vehicles.

Note on SoftBank: SoftBank's investment through a tender offer in November 2024, purchasing shares from employees at the same $157 billion valuation, highlights their strategic interest in OpenAI's growth while directly benefiting employees by providing liquidity, showcasing a different but equally valuable investment approach.

What makes Microsoft an Astute Investor?

What I like about how they have taken their investment is:

High Growth Potential: Microsoft's $11 billion investment in OpenAI reflects its recognition of AI's vast growth potential. OpenAI's valuation soared from $28.7 billion in April 2023 to $157 billion by October 2024 (almost 5x), validating Microsoft's foresight in capturing a slice of this burgeoning market (for now, at least).

Profit Sharing Structure: Microsoft's agreement to receive up to 75% of profits until they recoup their investment, then holding a 49% equity stake, showcases their financial acumen. This structure maximizes Microsoft's return on investment while ensuring sustained financial interest in OpenAI's success.

Diversified Investment: By backing OpenAI, Microsoft diversifies wider into AI, reducing dependency on traditional tech sectors, whilst it develops its own models or finds alternatives. This mirrors the strategy of astute investors who spread risk across high-potential areas.

Why is what Microsoft did so Amazingly Strategic?

More importantly, what makes it “commandingly brilliant”, are these points:

Investment at Entity Level: Microsoft's investment was made directly into OpenAI Global, LLC, a for-profit entity, which differs from other investors and employees whose stakes are managed through a holding company aligned with the nonprofit mission. This strategic placement gives Microsoft a clear path to financial returns and strategic influence (whilst the other “non-profit” entity’s conversion into a “for-profit” is being negotiated).

Exclusive Technology Integration: Microsoft secured exclusive rights to integrate OpenAI's AI models into their ecosystem, including Azure, GitHub Copilot, and Office 365. This exclusivity ensures Microsoft can leverage cutting-edge AI technology to maintain and expand its competitive edge. But, it can develop it’s own models to mitigate the over-reliance risk (which sounds like it is happening).

Enhancing Product Value: With GitHub Copilot reaching over 1 million paid users, Microsoft uses OpenAI's tech (for now) to boost productivity, adding significant value to their products, which can command premium pricing.

In-House R&D Through Investment: Through their investment, Microsoft essentially gains an advanced R&D team via OpenAI. This allows Microsoft to leverage OpenAI's expertise, accelerating their own AI model development, ensuring they remain at the cutting edge of AI technology.

Long-term AI Leadership: By partnering with OpenAI, Microsoft positions itself as a leader in AI, particularly in the pursuit of AGI, influencing the direction of AI innovation globally.

Cloud Computing Synergy: Azure's role as OpenAI's exclusive cloud provider creates a symbiotic relationship. OpenAI's computational demands fuel Azure's expansion, reinforcing Microsoft's cloud dominance.

Profit Threshold and Exclusivity: Microsoft's deal includes a profit threshold mechanism, where their profit share changes upon reaching certain financial milestones. This strategic arrangement not only secures exclusivity but also aligns with long-term financial goals.

Economic Calculations for Separate Returns (My Favorite bit): Microsoft has strategically calculated potential returns from their AI-enhanced products. For instance, with over 300 million paid Office 365 users, assuming one-third (or 100 million) subscribe to an AI-enhanced service like Office Copilot at $30 per month, this can easily generate $36 billion in annual revenue. This economic model demonstrates how Microsoft plans to recoup its investment through direct product sales and subscriptions, independent of OpenAI's profit share!!!

In essence, Microsoft's investment in OpenAI isn't just about financial returns; it's a calculated move to foster innovation, enhance product lines, and ensure most importantly - leadership in AI!! Never mind how they have risk-managed the entire investment!!

Some Thoughts on Azure Use (although nothing significant really…)

Given the context of Microsoft's investment in OpenAI, particularly regarding the use of Azure or credits tied to the investment, are there areas of concern?

Microsoft's Investment and Azure Use:

Strategic Integration: Microsoft's investment in OpenAI includes Azure being the exclusive cloud provider for OpenAI. This means all of OpenAI's computational needs for training, testing, and inference of AI models are met through Azure, which is key to OpenAI's operational success. This integration is not just about providing compute power; it's about deeply embedding OpenAI's technology into Microsoft's ecosystem, enhancing products like GitHub Copilot, Office 365, and Bing.

Investment Structure: Part of Microsoft's investment has been in the form of Azure credits, which allows OpenAI to use Azure services at a reduced or no cost. This arrangement benefits both parties: OpenAI gets the necessary computational resources at a lower cost, and Microsoft sees increased usage of its cloud services, potentially driving Azure's growth.

Regulatory Scrutiny: While there hasn't been specific public scrutiny from entities like the DOJ regarding Microsoft's Azure credits to OpenAI, the structure could theoretically be questioned in terms of:

Antitrust Concerns: Similar to how the DOJ is looking into Nvidia's investments in AI companies tied to GPU purchases (I don’t believe this is necessary given Nvidia are market leaders, and no surprise why AI Model companies naturally default towards their GPUs), Microsoft's deal could be scrutinized for potential anti-competitive practices, especially if it's seen as locking OpenAI into Azure, limiting competition in cloud services for AI workloads.

Fair Market Value: The valuation of the investment might be questioned if a significant portion is in non-cash Azure credits rather than direct financial investment, potentially affecting how the investment is reported or valued.

Comparison with Nvidia's Situation:

Nvidia's Investments: Nvidia's investments in AI companies are being examined by the DOJ in relation to their GPU sales, which are crucial for AI model training. The concern here is whether Nvidia's investments could influence these companies to exclusively or predominantly use Nvidia's GPUs, potentially stifling competition in the GPU market for AI applications. I reiterate my stand in that I do not believe this is necessary given Nvidia is The market leader, and no surprise why AI Model companies naturally default towards their GPUs.

Similarities: Both scenarios involve a tech giant providing essential resources (compute power via cloud services for Microsoft, GPUs for Nvidia) tied to their investments in AI-focused startups. The exclusivity or preference given in these arrangements could be seen as reducing competition in their respective markets (cloud computing for Microsoft, GPU market for Nvidia). But I also expect to see a more lenient-open M&A environment post-Lina Khan, post Jan 20th, 2024. So calling these “non-events” given the circumstances, seems about right…

Differences to note:

Nature of Resource: Microsoft provides cloud computing services through Azure, while Nvidia provides physical hardware (GPUs). The implications of exclusivity might differ; cloud services are more about ongoing service provision, whereas GPUs are a one-time purchase with ongoing relevance due to upgrades and new models.

Market Dynamics: The cloud computing market has different dynamics compared to the GPU market. Azure competes with AWS, Google Cloud, etc., whereas Nvidia has a dominant position in AI-specific GPUs, making the competitive landscape for scrutiny slightly different.

While Microsoft's investment in OpenAI, particularly the Azure credit aspect, could theoretically be questioned in terms of antitrust or market fairness, there's no direct indication of such scrutiny from sources like the DOJ, as of now (or the foreseeable future). However, the structure does share conceptual similarities with Nvidia's situation where investments are tied to the use of their products, raising potential concerns about market competition. The key for both companies would be ensuring their partnerships do not unfairly limit competition or create dependency that could be seen as anti-competitive.

It's worth noting that both companies' investments are strategic, aimed at fostering AI development while also enhancing their own product offerings or market positions, which is beneficial for innovation but must be balanced with fair competition practices.

Personal note: I actually believe that in both cases, Microsoft & Nvidia have fantastic & unique edges - Market Intelligence, untold insights and a “Pulse on Demand” (trends) which - If you are both a Strategic Investor and a Market Operator, are almost the “holy grail” of your business forecasts.

https://substack.com/@interestingengineering/note/c-129530473?r=223m94